Are you ready to take control of your finances and work towards achieving financial freedom? In today’s fast-paced society, managing personal finances can be overwhelming and daunting. However, with the right strategies and mindset, you can pave the way to a secure and prosperous financial future. In this blog post, we will explore a variety of personal finance strategies that can help you attain financial freedom. From creating a budget to developing multiple streams of income, we will delve into practical tips and techniques that can lead to a more stable and fulfilling financial life. Whether you’re looking to conquer debts, grow passive income, or simply save money for future goals, there are actionable steps you can take to improve your financial well-being. So, let’s dive in and discover which personal finance strategies can propel you towards financial freedom.

What's in this article :

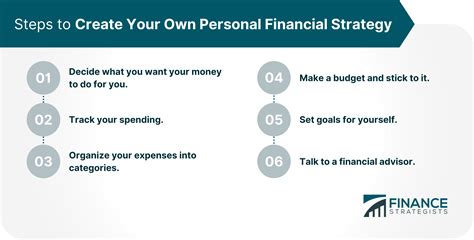

Creating a Budget: Boosting Financial Awareness

Creating a budget is an essential step in boosting financial awareness and taking control of your personal finances. It involves carefully tracking your income and expenses to ensure that you are living within your means and saving for the future. By setting financial goals and creating a budget to achieve them, you are taking proactive steps towards achieving financial security.

By creating a budget, individuals become more aware of their spending habits, identifying areas where they may be overspending and finding opportunities to cut back. This heightened financial awareness is crucial for making informed decisions about money and ensuring that every dollar is being put to good use.

Additionally, a budget provides a clear picture of where your money is going, allowing you to allocate funds towards different financial priorities such as debt repayment, savings, and investments. This not only helps you to stay on track with your financial goals but also empowers you to make intentional choices about how your money is being managed.

In conclusion, creating a budget is a fundamental step in boosting financial awareness and taking control of your financial future. It provides the necessary structure and visibility to make informed decisions about your money, ultimately leading to a more secure and stable financial position.

Implementing the Debt Snowball Method: Conquering Debts

Struggling with debt can be overwhelming, but implementing the debt snowball method can help you conquer your debts and regain control of your finances. This method involves paying off your smallest debts first and then using the freed-up money to tackle larger debts, creating momentum and motivation as you go.

By focusing on eliminating your smallest debts first, you can experience quick wins and build momentum toward paying off larger debts. This can provide a sense of accomplishment and motivate you to continue working towards financial freedom.

Another benefit of the debt snowball method is the psychological impact it can have on your mindset. As you pay off each small debt, you’ll experience a sense of relief and progress, which can keep you motivated as you work towards paying off larger debts.

Overall, implementing the debt snowball method can be an effective strategy for conquering your debts and taking control of your financial future. By starting with small victories and building momentum, you can work towards a debt-free life and achieve financial freedom.

Investing in Index Funds: Growing Passive Income

Investing in index funds is a great way to grow passive income over time. Index funds offer a diversified investment option, often tracking a specific market index such as the S&P 500. This means that investors can benefit from the overall performance of the market without having to handpick individual stocks. By investing in index funds, individuals can earn a return based on the performance of the overall market, providing a more stable and predictable source of passive income.

One of the key benefits of investing in index funds is the low fees associated with these investment vehicles. Unlike actively managed mutual funds, index funds typically have lower expense ratios, meaning that investors get to keep more of their returns. Additionally, index funds also have lower turnover rates, leading to fewer taxable events and potentially reducing the impact of capital gains taxes on the investment.

Another advantage of investing in index funds is the simplicity and diversification they offer. With just one investment, individuals can gain exposure to a wide range of companies and industries, reducing the risk that comes with putting all of one’s eggs in a single basket. This diversification can help to protect against the volatility of individual stocks and provide a more stable source of passive income.

Overall, investing in index funds is an excellent way to grow passive income while taking advantage of lower fees, diversification, and the overall performance of the market. Whether it’s for retirement planning or supplementary income, index funds can be a valuable addition to any investment portfolio.

Building an Emergency Fund: Safeguarding Financial Stability

Building an emergency fund is a crucial step in safeguarding your financial stability. Life is unpredictable, and having a safety net in place can provide peace of mind and protection against unexpected financial challenges. By setting aside a designated amount of money for emergencies, you can avoid relying on credit cards or loans in times of crisis.

Whether it’s a sudden medical expense, car repair, or temporary job loss, having an emergency fund can help you weather the storm without derailing your long-term financial goals. Financial experts recommend having three to six months’ worth of living expenses saved in an emergency fund, but even starting with a smaller amount is a step in the right direction.

Consider setting up a separate savings account specifically for your emergency fund to make it easier to track and avoid the temptation to dip into it for non-urgent expenses. Automating regular contributions to your emergency fund can help ensure that you prioritize this financial goal and steadily build up your safety net over time.

Ultimately, building an emergency fund is about preparing for the unexpected and taking proactive steps to protect your financial well-being. By prioritizing this financial cushion, you can navigate through uncertain times with greater resilience and avoid unnecessary stress related to money.

Developing Multiple Streams of Income: Diversifying Financial Resources

Developing multiple streams of income is a crucial step in diversifying financial resources and securing a stable financial future. By generating income from various sources, individuals can reduce their reliance on a single income stream and minimize the impact of economic downturns or job loss. This strategy also provides opportunities to pursue different interests and skills while increasing overall revenue.

One way to develop multiple streams of income is by exploring freelance work or part-time gigs in addition to a full-time job. This can include freelance writing, graphic design, photography, consulting, or tutoring. By leveraging existing skills and expertise, individuals can supplement their primary income and gradually build up alternative revenue sources.

Another option for diversifying income is by investing in rental properties or real estate. Generating rental income can provide a steady flow of cash while also allowing for long-term appreciation in property values. However, it’s important to carefully research and manage these investments to ensure financial success.

Diversifying financial resources through multiple streams of income also involves exploring passive income opportunities such as creating and selling digital products, investing in dividend-paying stocks, or building an online business. By leveraging technology and the internet, individuals can establish scalable and sustainable passive income streams that generate revenue with minimal ongoing effort. This approach not only increases overall income but also provides greater flexibility and time freedom.

Maximizing Tax Efficiency: Minimizing Obligations

When it comes to managing our personal finances, one important aspect that often gets overlooked is tax efficiency. Maximizing tax efficiency is crucial in order to minimize our tax obligations and retain more of our hard-earned money. By understanding the various strategies and tools available to us, we can make sure that we are not paying more taxes than necessary.

One effective way to maximize tax efficiency is by taking advantage of tax-advantaged accounts such as 401(k) and IRA. These accounts offer tax benefits and can significantly reduce the amount of taxes we owe. By contributing to these accounts, we can lower our taxable income and defer taxes on our investment gains, ultimately reducing our tax burden.

Another strategy to minimize tax obligations is to strategically plan our investment activities. Investing in tax-efficient funds and assets can help reduce the taxes we owe on our investment gains. Additionally, tax-loss harvesting, where we sell investments at a loss to offset gains and minimize taxes, is a valuable tool in maximizing tax efficiency.

It is also important to stay informed about the tax laws and regulations that may impact our finances. By staying up-to-date with the latest tax developments, we can adapt our financial strategies to take advantage of any new tax-saving opportunities that may arise.

Adopting Frugal Habits: Saving Money for Future Goals

When it comes to achieving your future financial goals, one of the most important things you can do is adopt frugal habits in your daily life. Frugal habits are about being mindful of how you spend your money and finding ways to save on everyday expenses.

One frugal habit you can adopt is cooking at home instead of eating out. Not only is this a healthier option, but it can also save you a significant amount of money in the long run. By planning your meals and grocery shopping strategically, you can minimize food waste and optimize your budget.

Another frugal habit to consider is embracing minimalism and decluttering your life. By reducing your possessions to only the essentials, you can avoid unnecessary expenses on material goods and reduce the potential for impulse purchases.

Furthermore, getting into the habit of comparison shopping and looking for deals and discounts can help you save money on everything from groceries to household items to clothing. Taking the time to compare prices and seek out bargains can make a significant difference in your overall spending.